A Simple Plan for CPA Partner Buy-ins

August 22, 2022 •Oak Street Funding

.png?width=600&height=314&name=Resources%20Thumbnails%20(7).png)

Typically, CPA firms devote a great deal of thought to leadership transitions, especially those related to partner buy-ins. Partner buy-ins have been on the rise given the recent trend coined “The Great Retirement” or “Silver Tsunami.” By 2030, all Baby Boomers will be 65+ and millions are already retiring every year. As the accounting industry prepares for these leadership shifts, now is the time to develop a formal buy-in plan.

The Plan

The plan for a CPA buy-in should cover four topics: who can buy-in, cost, financing options, and expectations for new partners. Each buy-in structure should be as unique as the firm. The plan is important because it helps make sure everyone knows what to expect. In some firms, new partners are surprised by the cost or expectations because they weren’t laid out in a concise format beforehand.

1. Who can become a partner?

The plan should describe the requirements for partnership to maintain fairness and give aspiring partners a roadmap to follow. Typically, CPA firms look for employees who go above and beyond, have integrity, and demonstrate a high level of both technical and leadership skills.

Some firms may offer partnerships to employees with a niche expertise that will increase the value of the firm’s services. In firms where the criteria are vague, favoritism or even nepotism can come into play. Therefore, the plan must include measurable metrics to help prevent these issues.

2. What is the cost of a buy-in?

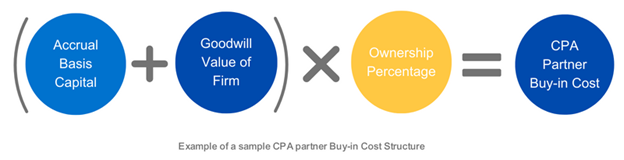

The cost of a CPA buy-in is typically determined by a valuation of the firm multiplied by the ownership percentage. However, as noted in the example below, some firms choose to add the goodwill value of the firm to the accrual basis capital, and then multiply by the partner’s percentage of the firm.

Other firms will set a fixed price for all buy-ins. The Rosenberg Survey polled 400 CPA firms and found the average CPA buy-in cost is $144,000. At some firms, new partners are expected to make an immediate payment in cash or assume a loan. Generally, it’s preferable to make those payments to the firm -- rather than directly to the other partners -- because doing so increases the firm’s capitalization.

3. What financing options are available?

Very few new partners have access to a large pile of cash, therefore many firms are creating opportunities for financing buy-ins. For some firms, that involves internal financing with repayments taken from future payroll and profit distributions. Others may expect payments quarterly or annually, perhaps deducted from future shares of profits.

What’s often a more practical and workable approach is for the firm to guarantee financing from an outside lender, helping the new partner obtain a better rate and terms than possible on his or her own. The new partner then pays the borrowed amount directly to the firm, which adjusts his or her compensation to cover the debt service. This approach gives the firm a healthy infusion of capital in return for taking on the minor risk of the loan guarantee.

As an example, Oak Street Funding® recently developed a special program to provide financing for CPA partner buy-ins. The new partners take out a loan from Oak Street Funding using the firm’s value as the collateral with a guarantee from the firm. With this plan, firms are able to expedite the buy-in process without dipping into their cash reserves or encountering potential payroll deduction problems. New partners are completely vested in the rights and privileges of full partnership immediately and the firm is not responsible for holding a note.

4. What are the expectations for new partners?

The plan should also include the expectations for new partners. What performance metrics or professional development milestones are they expected to reach and when? If he or she fails to meet the expectations, what measures will be taken? Making partner in a CPA firm isn’t a finish line; in fact, it is a level up to greater reward and responsibility. At a minimum, partners should maintain the credentials they held when they made partner.

However, many new CPA partners find they must work longer hours to ensure the firm’s profitability which is now more directly tied to their compensation. It is important that CPAs aspiring to become partner and their firm agree on the expectations to prevent misunderstandings.

Conclusion

Making partner in a CPA firm is an exciting milestone many CPAs work hard to achieve. Following an established plan for buy-in will help ensure a successful transition. Additionally, using outside capital to finance the cost of the buy-in can help eliminate friction points. Oak Street Funding’s new CPA partner buy-in financing solution helps ensure the firm and new partners’ financial needs are met. With a customized solution tailored to the needs of each firm, our CPA buy-in financing is simple and the time from application to funding is short. Contact me today to get started!

Bruce Warren | VP Sales, CPA Commercial Loans

Bruce has 30+ years of experience in commercial lending with nine years focused solely on the professional practice industry. You can reach Bruce calling 844-347-0321 or send him a message here.

Disclaimer: Please note, Oak Street Funding does not provide legal or tax advice. This blog is for informational purposes only. It is not a statement of fact or recommendation, does not constitute an offer for a loan, professional or legal or tax advice or legal opinion and should not be used as a substitute for obtaining valuation services or professional, legal or tax advice.