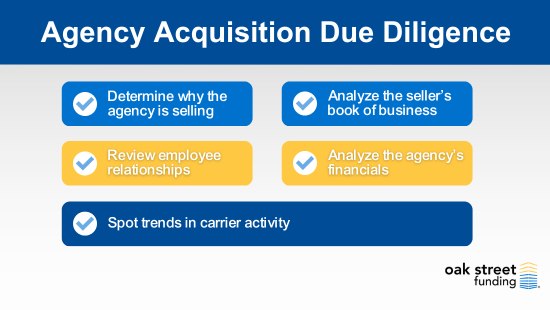

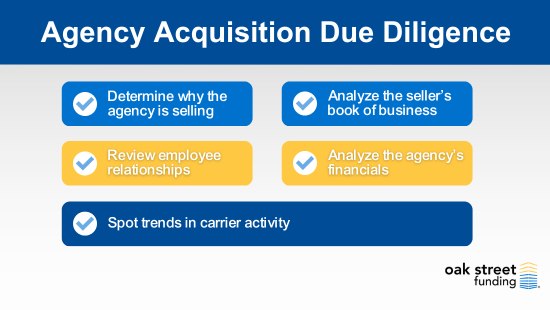

Mergers and acquisitions failures are largely because buyers don’t perform — or adequately perform — the right kind of due diligence analysis. Whether you’re planning to make an asset or stock purchase, do your homework to learn as much as you can before deciding to acquire another insurance agency. Here are some key areas to research.

1. Determine why the agency is selling

There are many legitimate reasons for selling, such as retirement or succession planning, but sometimes there are other hidden factors. Make sure the seller doesn’t have any skeletons in the closet that could hurt your business down the road. If the acquisition is a stock transition, which carries more risk than an asset transaction, you need to investigate more.

Contact carriers that have been used in the past, review the state insurance department website, contact the local Better Business Bureau and conduct Internet searches. All these resources could reveal evidence of trouble.

2. Analyze seller’s book

Look beyond total commissions from the past few years. See what percentage of the accounts have been on the books for two years, for five years, and even for 10 years. If the agency acquisition has an earn-out provision, ensure that what the seller is representing on the commission book is truly in force. Plus, review the agency’s loss ratios, carrier persistency, carrier contracts, and types of accounts. Anticipate the likelihood of clients sticking around after the acquisition. Identify trends in commissions.

For example, if total commissions have doubled in the past three months, or if the agency just landed a huge new commercial contract that now represents a disproportionate share of commissions, you need to determine why. Review the average commission per account and determine the mean, the median, and other pertinent statistics.

3. Review employee relationships

Only consider agencies with an ironclad non-compete contract, which will be followed not only by the seller but by the agency’s producers. In cases when an agency is about to be sold, many of its producers view the imminent transaction as a threat to their livelihood. A few of the less ethical ones may use this uncertainty to justify shifting accounts to their own private businesses or to another agency promising a more favorable commission split. The best-case scenario is for employees to be under an employment agreement that includes both a non-compete agreement and a non-solicitation agreement.

4. Analyze financials

See if the selling insurance agency’s tax returns match up with the commission statements – a good independent check on what the seller represents. Also examine ratios, margins, and non-operating expenses. If assets are being purchased, they should be well-defined. In addition, buyers should ensure the following:

-

- The assets are free and clear of all liens and encumbrances.

- The value of the book is as represented.

- All taxes are paid.

- The seller is in compliance with all laws.

5. Spot trends in carrier activity

Determine with which insurance companies the agency is placing most of its business. See if these carriers plan to lower commission rates, give less favorable terms with contingent contracts, change product offerings, or are considering pulling out of your state. Talk to the carrier representatives for this information. Find out if the carriers’ direct writers have been trying or succeeding in encroaching on the agency’s business. Always retain copies of all the agency’s contracts with carriers.

Acquisition funding

If you need a loan to fund an acquisition, acquisition financing is available from different sources. A bank is usually the first funding source to be considered, but most banks lend on balance sheet financials and aren’t willing to lend against the future cash flow embedded in an in-force book of business. Consider a lender that has funding just for insurance agencies.

With a loan that allows you to borrow against future commission streams, you won’t have to risk losing control of the business you built. It’s a solution hundreds of insurance agency owners have used to finance acquisitions. If you choose to fund an insurance agency acquisition from a lender, the due diligence you perform early on will provide a head-start on the loan approval process.

At Oak Street Funding, we have experts in lending who have helped thousands of potential clients determine if a loan from a specialty lender is right for them. Please feel free to contact us about a business acquisition loan.

/Resources%20Thumbnails%20(47).png)

/Resources%20Thumbnails%20(20).png)