.png?width=600&height=314&name=Resources%20Thumbnails%20(41).png)

Business owners contemplating an exit in the foreseeable future who want to leave as much as possible to their heirs need to become familiar with two tax-advantaged opportunities we’ll detail in this updated unified tax credit guide for 2024.

What exactly is the unified tax credit?

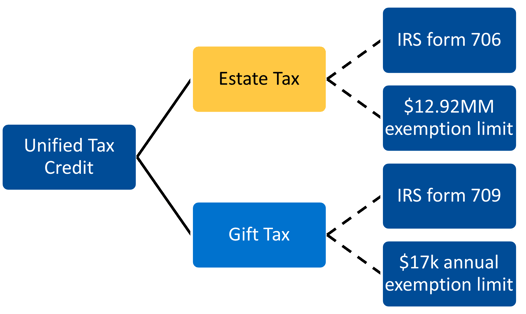

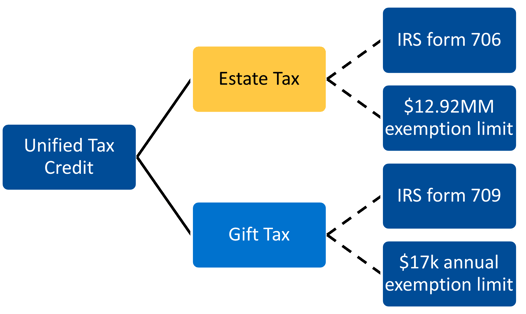

The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer substantial amounts of assets to heirs without triggering the need to pay gift, estate, or transfer taxes. They are particularly valuable to business owners who intend to pass ownership of their companies to heirs or trusted employees. And, because Congress recently increased the limits of these exemptions, 2024 is a great time for business owners to consider whether the unified tax credit supports their exit and estate planning strategies.

In simple terms, the unified tax credit describes the amount of assets business owners and other individuals can give to family members, employees, and anyone else without being liable for federal gift, estate, or transfer taxes. It’s a credit that’s available to everyone, no matter how large or small their base of assets may be.

The so-called death tax

Since the beginning of the United States, the government has recognized that the transfer of personal wealth between generations can be an excellent source of revenue. From 1797-1802, Congress required federal stamps on probate wills and inventory receipts of the deceased to fund the construction of naval ships. During the Civil War and Spanish-American Wars, Congress created short-lived inheritance taxes. The current estate tax conservative lawmakers often call the “death tax” was first enacted in 1916 and became a permanent part of the tax code in 2012.

Today, the federal government taxes qualifying estates up to 40 percent, and 17 states (and the District of Columbia) have their own taxes on the value of inheritances and estates. Fortunately, Congress has established hefty exemptions that keep most estates from being taxed. For 2024, the lifetime gift and estate exemptions increased to $13.61 million per individual and $27.22 million for married couples. So, if someone left a $15 million estate, only $1.39 million of it would be subject to federal tax.

The gift tax

Congress enacted the current gift tax in 1932 to make it more difficult for wealthy individuals to sidestep the inheritance tax by transferring large amounts of assets while they were still alive. Over the years, Congress has gradually increased the size of gifts individuals can make without triggering the tax. In 2024, individuals can give up to $18,000 per year to as many other individuals as they want without paying the gift tax. Together, married couples can give up to $36,000 in gifts.

Suppose a business owner and spouse planned to leave their closely held corporation to their five children. Each spouse could gift tax-free shares of the corporation to each child every year, gradually transferring the value of the business. This year, they could give each child a combined $36,000 without triggering the federal gift tax. Gifts above the $18,000 per giver amount will reduce the lifetime gift and estate exemption by the amount over $18,000.

Unified tax credit strategies

How the unified tax credit may apply to you depends on whether you prefer to use it to benefit the people you’re giving to while you’re still alive or to reduce the taxable portion of your estate after you die. Because probate and other estate issues may be costly in some jurisdictions, some business owners might prefer to preserve the full value of the unified tax credits, so their heirs have less to pay in estate taxes. Others would rather distribute more than the exempted amount while they’re still living, reducing the estate tax exemption.

Important to pay attention

Rules related to the unified tax credit are a favorite target for legislators, and the amounts and provisions are constantly subject to change. For example, current law includes a 50 percent cut in the estate tax exemption starting in 2026. Unless Congress changes the law, after January 1, 2026, exemption amounts will return to 2017 levels. That's why it's critical for any business owner who plans to use the unified tax credit to work closely with their CPA or other tax professional to maximize the benefits of the unified tax credit.

.png?width=600&height=314&name=Resources%20Thumbnails%20(41).png)

/Resources%20Thumbnails%20(47).png)

/Resources%20Thumbnails%20(20).png)