.png?width=600&height=314&name=Resources%20Thumbnails%20(84).png)

Business owners exploring financing options often wonder how lenders decide whether their business qualifies for credit. Homebuyers know that mortgage lenders look at credit scores and income-to-debt ratios when making decisions, but the process may be less straightforward when it comes to business financing options.

How do lenders determine eligibility?

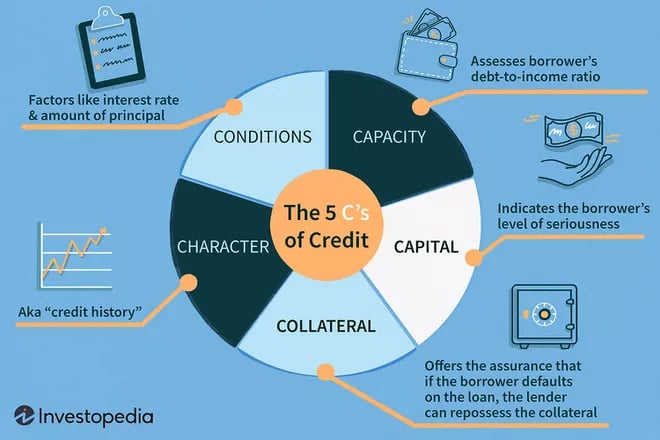

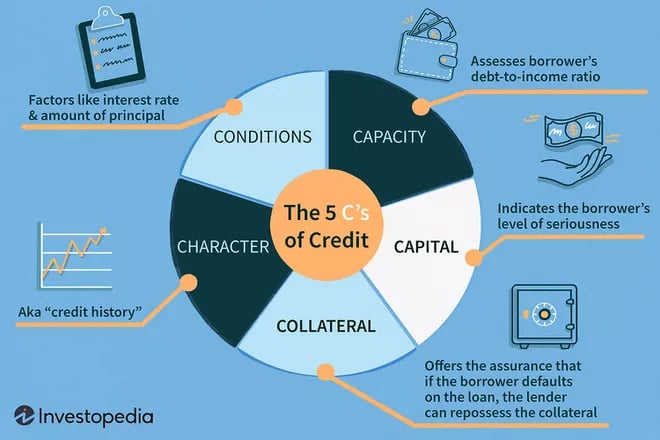

When a business applies for a loan, the lender compares its financial health to an established set of standards. Those standards and the factors measured vary by lender, but most can be categorized into the five Cs of Credit: capacity, character, collateral, capital, and conditions.

- Capacity refers to the debt load a company can sustain. Lenders are evaluating if the borrower can repay the loan without hurting the profitability of the company. To determine this, Oak Street Funding looks at the Cash Flow/EBITDA ratio. EBITDA is an abbreviation for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s common for lenders to offer businesses credit based on a multiple of EBITDA.

-

Character – “From our perspective, we want to know the character of our borrower. We work with great people, and we want to take the time to get to know them and make sure we understand who they are,” says Rob Roach, Oak Street Funding’s director of underwriting. Lenders will look at items like personal credit reports to help paint a picture of the potential borrower’s character. This evaluation gives lenders insight into the trustworthiness of a borrower and the likelihood that they will repay.

-

-

- Collateral is the assets a borrower pledges to the lender to secure the loan. In case the borrower defaults, the lender can take those assets as repayment for the loan. Below are two examples of metrics lenders may use to determine if a business has sufficient collateral for a loan.

-

- Business valuation. This number represents the business's value, similar to an appraisal of a residential property or home. Lenders often use third-party valuations to ensure they don’t lend more than the value of the business.

- Commissions/revenues. Cash flow lenders like Oak Street Funding use future commissions or similar revenue streams as the basis of their financing programs, looking at the company's business quality and how well it retains clients or customers.

-

-

- Capital refers to how much equity the company has available. Rob says, “We look at a lot of capital ratios to make sure the loan will not overleverage the borrower.” Lenders also want to know how much the borrower is putting down to finance the assets. Some lenders have down payment restrictions borrowers are required follow.

-

-

- Conditions are the specifics of the loan and factors that may influence it. Lenders will consider the macroeconomic and geopolitical factors that may hinder a borrower or impact the terms of the loan. Today’s interest rates are a rapidly changing condition many lenders are monitoring as they may impact portfolios.

What documents do lenders look at?

Lenders will ask for several types of documents to help evaluate eligibility. The four types of documents your lender may want to review include:

-

Financial statements for the past 2-3 years;

-

Company tax returns for the past two years;

-

Pro-forma financials that forecast the expected future revenue; and

-

Personal financial statements that establish the financial character of stakeholders.

How much can your business expect to receive?

The amount you can expect to receive depends on many factors. Based on their analysis, lenders will not only determine eligibility for a loan, but also the amount they are willing to lend. For example, the variability in how much debt Oak Street Funding will lend is heavily influenced by the enterprise value of the company, among other factors.

If you’re currently considering your company’s financing options, a sensible first step is to have a conversation with potential lenders to better understand how they make loan decisions, and which factors they consider. Many lenders are eager to lend money to viable businesses. Knowing the factors they will consider will help you determine whether your company is likely to qualify and how much you can expect. A strong relationship with potential lenders long before you need capital is an important first step to making your goals a reality.

If you are considering taking out a loan and don’t know exactly where to begin, please feel free to contact us. At Oak Street Funding, we have experts in lending who have helped hundreds of clients make their funding goals a reality. We provide capital to support your business today, and your success tomorrow.

.png?width=600&height=314&name=Resources%20Thumbnails%20(84).png)

/Resources%20Thumbnails%20(47).png)

/Resources%20Thumbnails%20(20).png)