.png?width=600&height=314&name=Resources%20Thumbnails%20(21).png)

Despite rising interest rates and economic upheaval, M&A activity in many industries is still high. Though mergers and acquisitions are often referred to in the same breath, most transactions are acquisitions. So, what about mergers? Though less common and less talked about than acquisitions, mergers are a valuable and beneficial growth strategy.

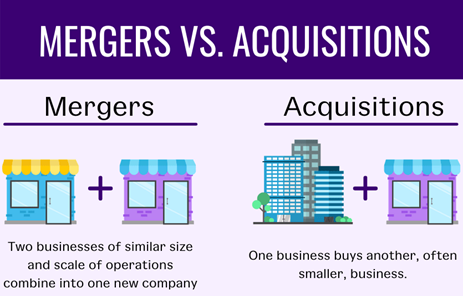

Merger vs acquisition

In a merger, owners of two different companies merge their services and operations and a new company is created. This is different than an acquisition where one company takes ownership of another. Acquisitions are more common in scenarios where an owner is planning to leave the company at some point after the acquisition. In a merger, the owners of both companies typically remain in leadership roles in the newly formed organization as in the example below.1

John owns a CPA practice specializing in tax services with a staff of 10 people. He wants to expand his offerings to include audit services, but his office and staff are at capacity. Samantha owns a CPA practice specializing in audit services with a staff of eight people. Like John, she wants to expand her client offerings. Together, John and Samantha combine their staff and resources to become partners in a new CPA practice. Now both John and Samantha’s clients have access to more services and the new practice produces increased revenue for both owners. This merger example is specific to CPA practices, but the scenario could apply to any industry.

Types of mergers

There are five common types of mergers, but vertical mergers are the most common. In a vertical merger, companies at different stages in the same industry’s supply chain combine their operations. This type of merger removes a step in the supply chain, decreases operational costs, and increases the value of the new company. A popular example of a vertical merger is the 2018 merger of Time Warner and AT&T. At the time of the merger, projections for cost synergies were over $1 billion.

Horizontal Merger

In a horizonal merger, two companies that are direct competitors combine to create a new larger company with greater economies of scale. The combination of staff and resources can reduce operating costs while increasing the level of service to clients. A horizontal merger may be an opportunity for the partners to divide responsibilities so they can each focus on what they love. Additionally, the new company has a greater revenue stream than the revenue of the two companies before they combined because there is less competition for the new company. For example, two independent insurance agencies offering similar policies in the same city may combine to gain a greater share of the market in that city.

Conglomerate Merger

A conglomerate merger occurs when two companies offering unrelated products or services create a new company. The shareholders of both companies feel that a merger will increase revenue and value for customers despite the differences. An example of this is the merger of a CPA practice and an RIA firm. CPAs and RIAs offer very different services, but the clients of both companies benefit from the combination of services that may be offered at a discount. Additionally, the new company experiences increased revenue from the clients that require services from a CPA and an RIA.

Concentric Merger

Concentric mergers are also known as product extension mergers. In this scenario, companies in the same industry who offer different products or services combine to reach a larger segment of customers. For example, insurance company A offers life and health insurance while company B offers auto and home/renter insurance. When combined, the new company can provide services to a wider range of clients with different needs.

Market Extension Merger

Lastly, a market extension merger occurs between merging companies that offer similar products or services, but in different markets. The objective of a market extension mergers is simply to increase the geographical reach of the company and thus increase market share. For example, two RIA firms in neighboring cities may merge and service the entire region from a central location.

Benefits of mergers

The benefits of a merger are closely related to the objectives of the merger. A horizontal merger reduces competition while a market extension merger increases market strength. The goals of the business owners are reflected in the type of merger they participate in. If a business owner wants to expand into a niche area of their industry, then they may pursue a concentric merger.

Mergers are also a great way to develop employees of both companies and build a stronger organization. In a tight talent pool, mergers provide a great way to increase employment benefits. A larger organization can often provide better benefits than a smaller organization which can improve employee retention.

Consider a merger to unlock greater potential for your business and better serve your clients. If you need funding to finance your merger, contact Oak Street Funding® for expert lending service and industry knowledge.

1 Example for illustrative purposes only; not a real-life example.

.png?width=600&height=314&name=Resources%20Thumbnails%20(21).png)

/Resources%20Thumbnails%20(47).png)

/Resources%20Thumbnails%20(20).png)